Please check your personal information carefully (Residence Country, VAT number, Account type) in order to comply with general TAX requirements.

For Publishers:

If you have a company account into Publishers' dashboard and your company is registered in the European Union you can take it into account when issuing the invoice.

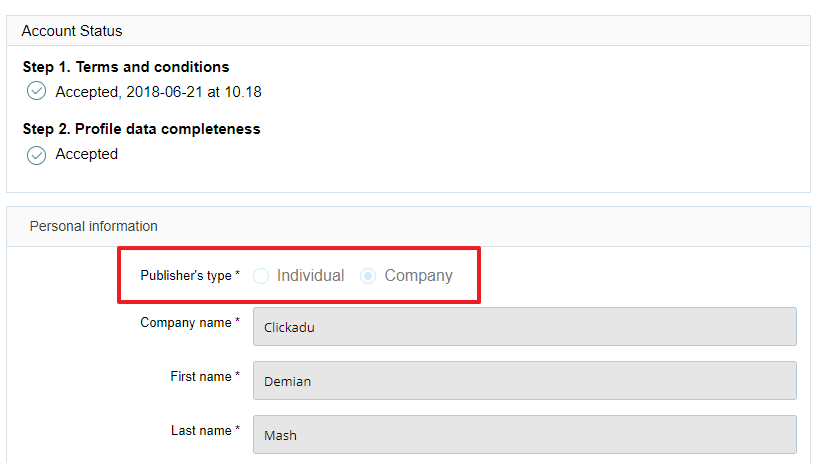

To check your account type go to the profile section. Please contact your manager to switch the account type.

It doesn't involve: individual accounts and other economic consolidations.

For Advertisers:

Please note that 21% TAX will be applied for:

- European Union residents with no valid VAT number applied (this includes Individual accounts).

- Czech Republic residents both Company and Individuals.

It doesn't involve: other economic consolidations.

VAT will be applied to the traffic expenses for advertisers that match the conditions above.

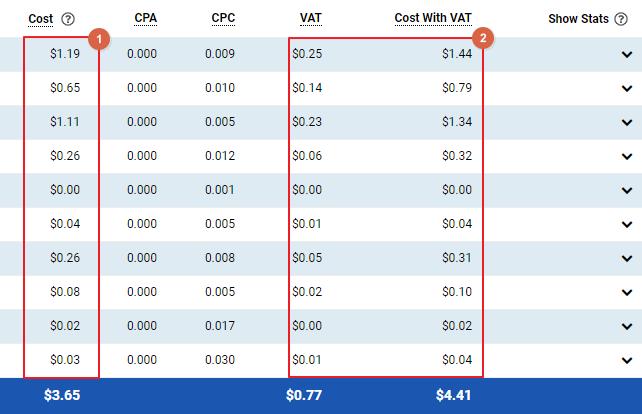

You can find the information regarding tax collections in the Self-Serve Platform dashboard section.

1. Traffic cost with no VAT.

2. Calculated VAT for the purchased traffic + cost with tax collections.

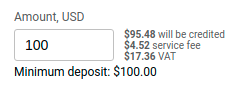

I see VAT calculations while topping up the balance. What does it mean?

Don't worry, the tax collections will be applied to the expenses for purchased traffic only.

This label indicates the total VAT amount that will be deducted according to the deposit amount.

Member-countries of the European Union:

| Austria | Portugal | Denmark |

| Italy | Finland | Poland |

| Belgium | Romania | Estonia |

| Latvia | France | Spain |

| Bulgaria | Slovakia | Hungary |

| Lithuania | Germany | Sweden |

| Croatia | Slovenia | Ireland |

| Luxembourg | Greece | Czechia |

| Cyprus | Malta | Netherlands |